With a downturn in the economy, both in the global and Chinese markets, it’s always a question of how resilient is the entertainment industry in these times? We know many went flocking to movies during the great depression, and the music industry wasn’t affected by the 2008 crisis. So what about today’s downturns? Will gaming be unaffected by the issues of Covid and an expected global recession?

A report by Gamma Data, a group that follows the Chinese game industry, shares the first half of the game industry. The “China Gaming Industry Report January – June 2022” has a lot of interesting insights and challenges that we need to address for the rest of the year.

Major News Points

- On March 14, a new push from the government for companies to add a “minor’s mode” for popular apps, adding to the already three hours a week limits on video games introduced last year. They also asked the public for their suggestions on protecting minors from the internet.

- On April 15, bans were put in place for live streaming games that were unavailable for sale or purchase in China on local live streaming channels.

Overall Sales

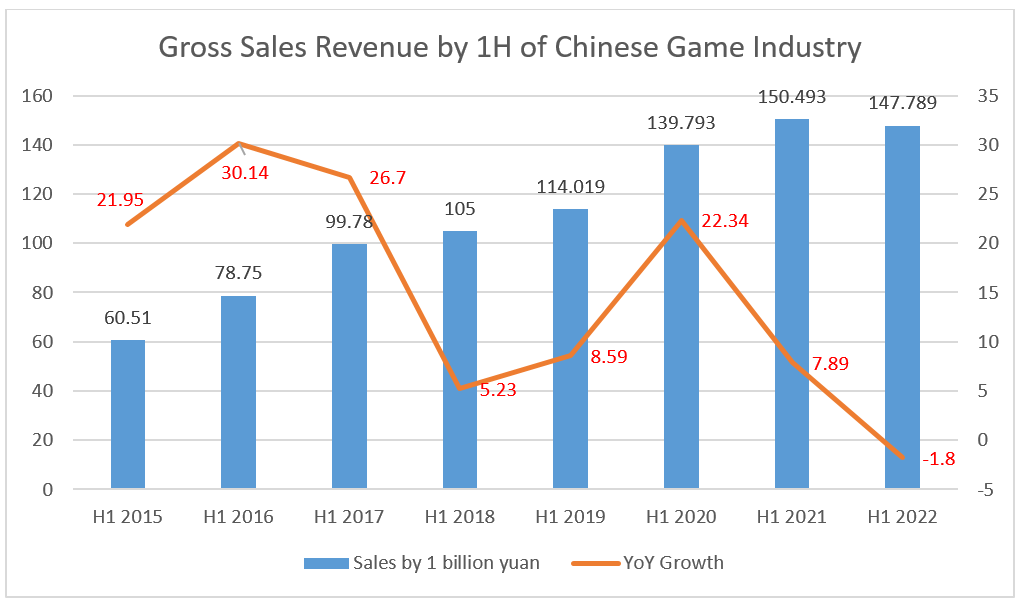

Due to the massive epidemics happening in China and other factors, this is the first year in history that profits were down in China.

For the first half of this year, sales revenues were down to 147.789 billion yuan, a decrease of 1.8%. This is still higher than 2020’s first half, so there is the question of if this is a trend down or a stabilization of the industry. We’ll have to wait for another report to see where things are going.

On the bright side, there was a very minimal loss in the casual mobile game market with a growth of 0.1% in sales.

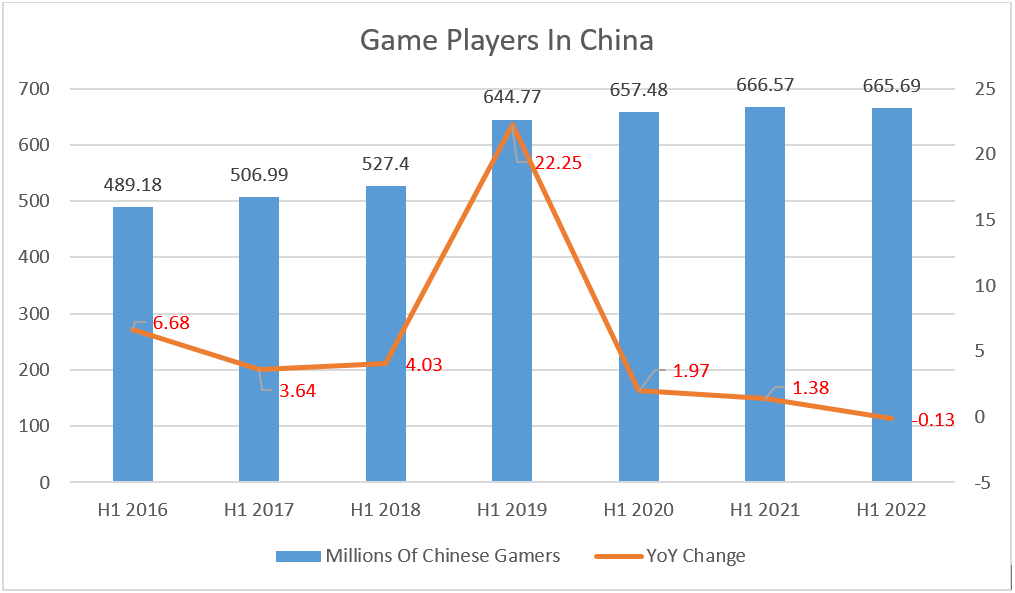

But one of the factors for the loss that we can already see is the loss of gamers this year.

There are currently 665.69 million gamers in China this first half, a drop of 0.13% from last year. This stabilization might be part of the cause, as well as regulations starting to affect youth players.

Domestic vs. Overseas

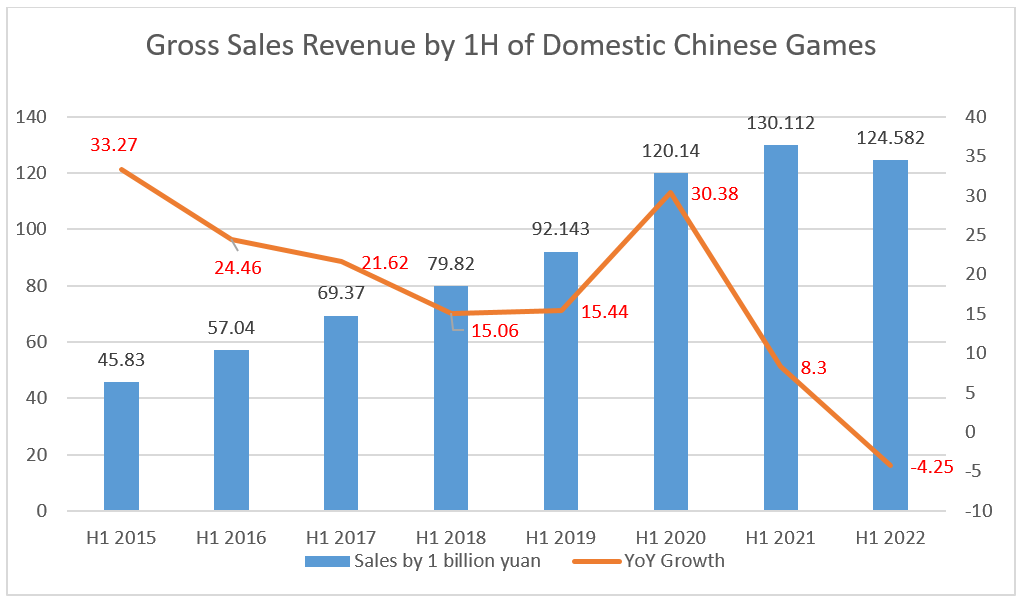

One of the big pushes that we are sharing with Chinese developers is to go overseas with their games. There are many very talented developers, and the ISBN process has been slower than people expected this year. From looking at the domestic sales numbers for this first half of the year, the trends are starting to show what we expected.

Only 124.582 billion yuan was taken in by sales, a YoY drop of almost 5% (4.25%). Though again, better than 2020, it’s yet more fears that this could either be a steady drop or a new baseline for the year.

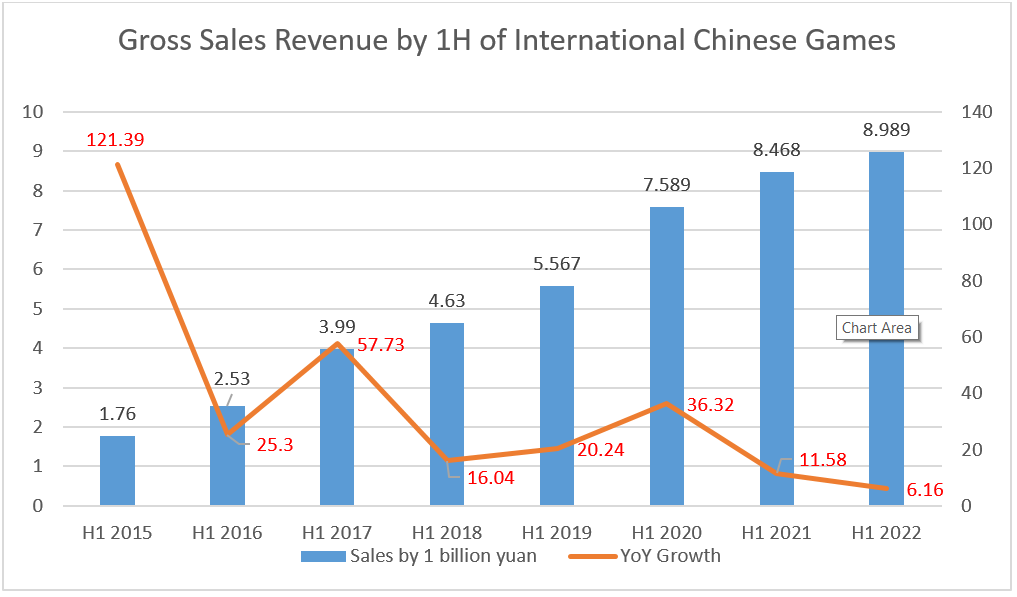

Comparing this decline to the international revenue, things are looking very good with the sales continuing to increase gradually.

Though only half of what was done the year before, the 8.989 billion yuan is the highest in the past ten years (a YoY of 6.16), and we hope to keep this trend going with the improvements happening with the Cocos Creator software and our work to help developers go overseas.

Most of the sales for Chinese games are coming from the USA (31.7%), Japan (17.5%), South Korea (6.29%), Germany (5.02%), and the UK (3.1%).

What Were Chinese Gamers Playing?

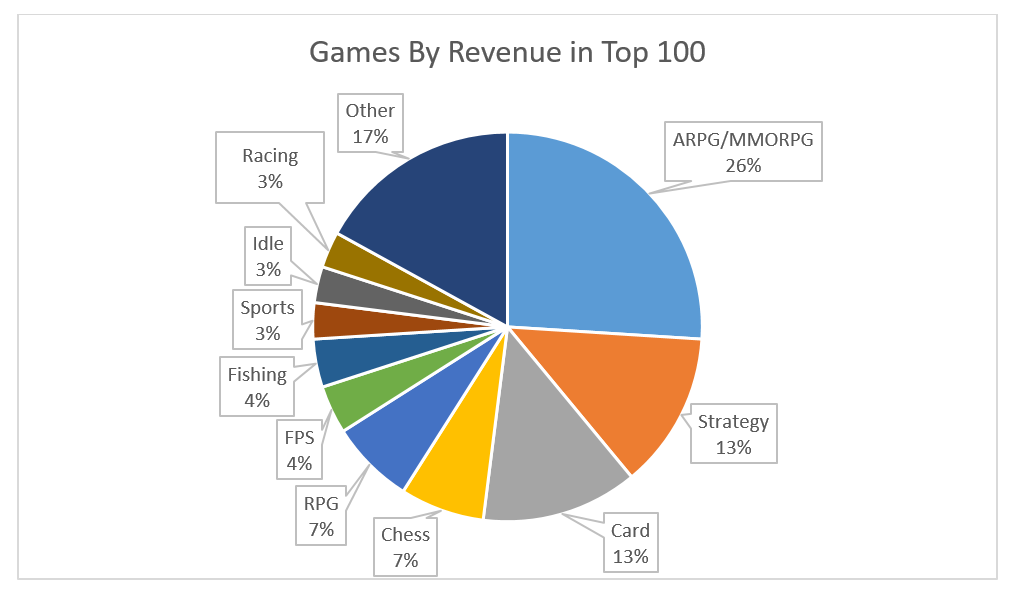

The landscape has changed once again as we’ve seen a swap of the top genres with MMORPGs back to leading Strategy games that were dominating the space late last year. A few games have also been pushing on the free #1, just like the hit, Li Guofu’s Little Days, built using Cocos Creator.

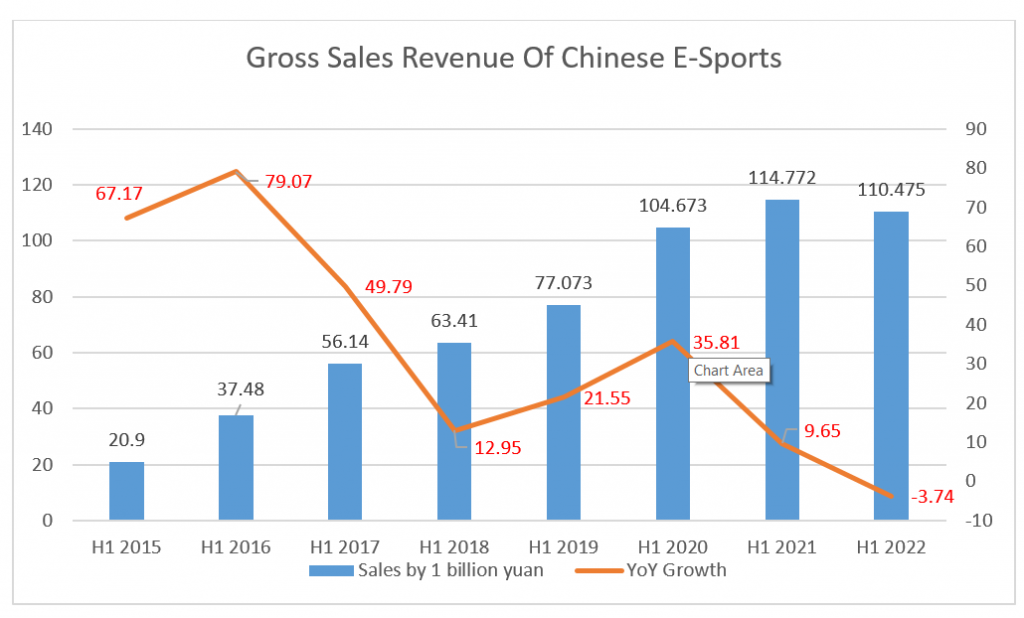

E-Sports Down, But Not Out

The most significant loss in this report has to be to the E-Sport groups. We talked in past stories about how they may have hit their limits, and this report may strengthen that analysis. Though the three months of lockdowns in Shanghai, one of the significant e-sports areas, could also have helped in crippling the work done by those in the sector.

With a YoY drop of almost 12%, the numbers for sales revenue are currently at 63.712 billion yuan. This is the biggest drop amongst everything this year. Though players are still staying at a constant rate(Only a 0.22% drop), this number is better than what was received in 2019 and 2020. So with no future lockdowns, will there be a bounce back?

Final Thoughts

This year is already looking to be a down year. But the losses in the game industry aren’t as bad as some would expect. This means good news for some in the industry as it’s a time to reset and start working on the future games that should be coming out after this troubled time. But for those already trying to maintain what is in their inventory. Deep discount deals and more exciting events will need to happen to keep revenue flowing until improvements in the economy come.